The Department for Energy Security and Net Zero, on behalf of the UK Emissions Trading Authority, commissioned a consortium led by CAG Consultants to undertake an evaluation of UK Emissions Trading Scheme, working in partnership with Winning Moves and University College London and Cambridge Econometrics. The first phase of the evaluation focused on UK ETS processes and outcomes since its establishment in 2021, while the second phase will focus on UK ETS impacts, starting in 2025 when more evidence is available.

The UK ETS was established in January 2021, following on from UK participation in the EU Emissions Trading System (EU ETS) from 2005 until the UK’s exit from the EU in December 2020. The UK ETS applies to power generation, energy intensive industry, offshore oil and gas, and aviation. The scheme covers around a quarter of the UK’s domestic emissions, so it is an important policy for achievement of the UK and devolved governments’ net zero targets.

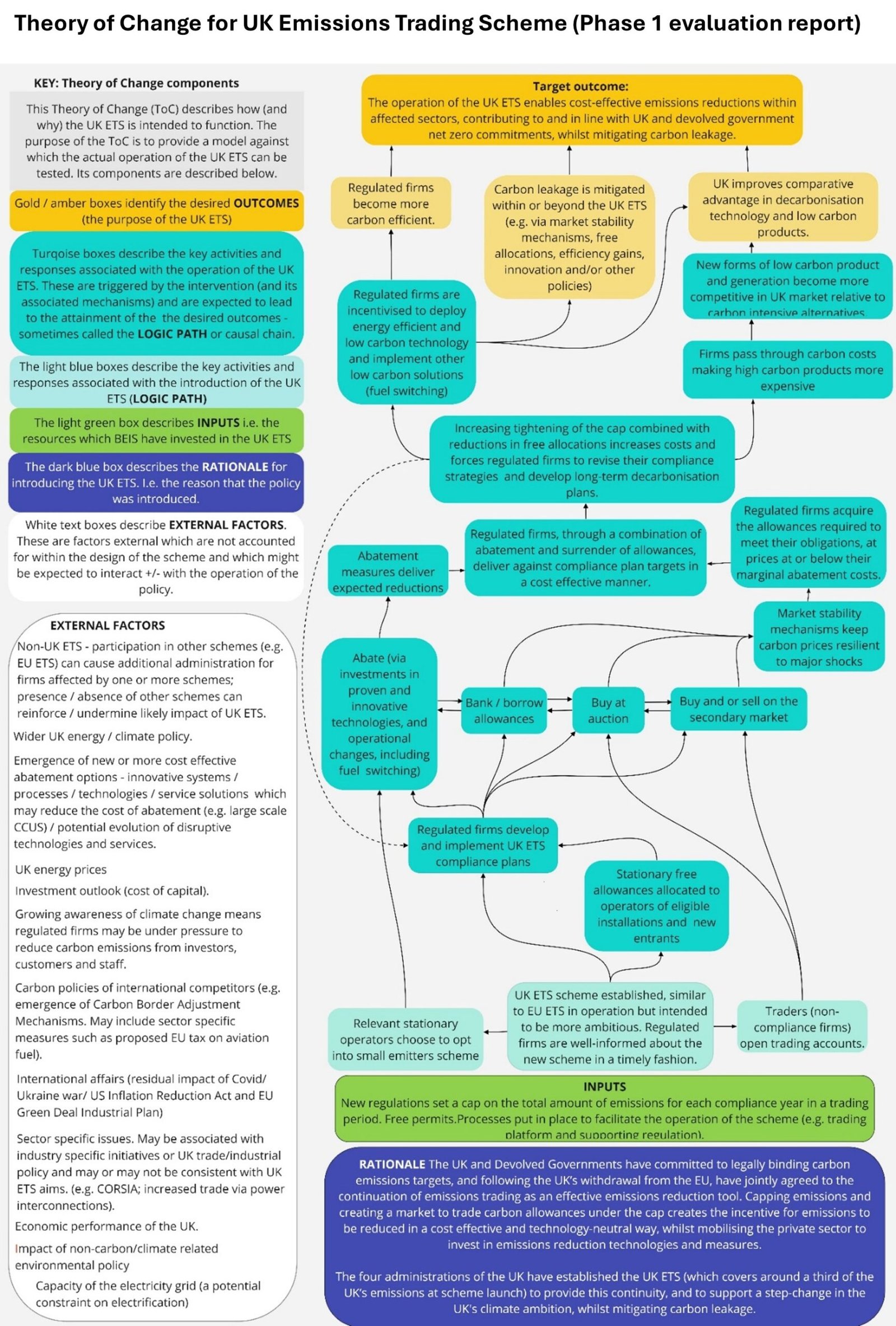

The UK ETS is a ‘cap and trade’ scheme that aims to incentivise cost-effective Greenhouse Gas (GHG) emissions reductions at the pace and scale needed to deliver the UK and devolved governments’ climate targets, while providing appropriate mitigations against carbon leakage. (Carbon leakage is defined as the movement of production and associated emissions from one country to another due to different levels of decarbonisation effort through carbon pricing and climate regulation.) Through this ‘cap and trade’ scheme, the UK and devolved governments impose a limit on GHG emissions from sectors covered by the scheme and firms can trade emissions allowances within this limit.

How we delivered the project

This evaluation is theory-based and uses contribution analysis to test a theory of change against a set of competing hypotheses. The theory of change for the scheme, shown above, was developed by CAG Consultants in partnership with the UK ETS Authority. Phase 1 of the evaluation focused on UK ETS processes and outcomes, with some preliminary findings about UK ETS impact. Phase 1 research involved a survey of UK ETS participants, in-depth research with selected participants and UK ETS traders, as well as a literature review of ETS market quality and detailed analysis of UK ETS market data, brought together in an overall synthesis. Phase 2 (in 2025/26) will examine UK ETS impacts more fully when further objective evidence is available. An example chart from the survey is shown below.

How important was the cost of UK Allowances (UKA) in influencing your organisation to increase decarbonisation investment? (all main scheme participants acknowledging UKA cost influence; n=99)

Source: quantitative survey (all main scheme participants acknowledging UKA cost influence).

Qualitative researched used a realist approach to explore ‘why, how and in what circumstances’ the scheme triggers different reasoning by different types of organisations (Pawson & Tilley, 1997). This involved the development of realist theory: causal hypothesis set out as ‘context mechanism outcome’ configurations (CMOs). The candidate theories were tested against evidence from in-depth qualitative interviews with UK ETS operators and traders, as well as wider stakeholders. They were also tested against evidence from a quantitative telephone survey with UK ETS operators and analysis of the UK Transactions Log.

The Phase 1 report presents refined CMOs describing observed trading behaviour by UK ETS traders and compliance organisations. These refined theories characterise different types of trading behaviour (e.g. market making, broking, clearing, speculation and compliance-related trading). Drawing on qualitative and quantitative research evidence, the report also explores whether and why different types of compliance and non-compliance traders use the primary auction, secondary market or ‘over the counter’ trading, and whether/why they trade in physical UKA, futures or forward contracts. The report interprets these findings in the light of the UK ETS Authority’s policy goals for the UK ETS.

Finally, the report also presents refined realist theories for planned GHG abatement behaviour by UK ETS compliance organisations. Again, this allows characterisation of the types of abatement behaviours reported by UK ETS compliance organisations, the circumstances in which each type of behaviour is observed and interpretation of any consequences for UK ETS policy goals.

Objectives achieved

CAG Consultant’s evaluation report is published here: Phase 1 report. Key findings from phase 1 of the evaluation were that:

- The transition from the EU ETS to the UK ETS in January 2021 generally worked smoothly, largely because the UK ETS was designed to be very similar to the EU ETS.

- Levels of participant satisfaction with UK ETS processes were generally high, as were levels of satisfaction with the services provided by UK ETS regulators.

- While participants with high emissions (more than 50,000 tCO2e in 2022) reported that they bought allowances more than once a year, about half of participants (generally those with lower emissions) reported that they bought allowances once a year to meet their compliance requirements.

- Most participants reported that they bought physical UKA or UKA derivatives (for example futures and forward contracts) via banks or brokers because this was the easiest and simplest route, avoiding the need for them to develop trading expertise and register for the primary auction or ICE platform.

- A small proportion of participants with high emissions reported that they bought physical UKA at auction and traded directly in futures contracts on ICE. These were primarily operators/AOs with specialist trading arms or in-house expertise in trading.

- The behaviour of in-house and financial sector traders was analysed to comprise clearing, market making, broking, compliance trading and speculating. Network analysis found that market making was important for market liquidity, while speculation was less widely observed and appeared to contribute less to market liquidity.

- Traders expressed concern about perceived lower liquidity and higher volatility in the UK ETS compared to the EU ETS. However secondary market data analysis found that key metrics of market quality for the UK ETS were similar to the EU ETS, albeit with more variation in these metrics over time than in the larger EU ETS market. Some elements of the market data analysis were based on limited time series and are subject to confirmation by further analysis over a longer timescale.

Early findings on carbon reduction and carbon leakage were as follows, to be researched in more detail during phase 2 of the evaluation.

- The majority (90%) of UK ETS participants reported having a plan to reduce carbon emissions. Although there were multiple drivers influencing both current and future abatement strategies, over 4 in 10 participants reported that the UK ETS influenced their awareness of carbon reduction opportunities to a ‘great’ or ‘large’ extent.

- Based on early evidence, this evaluation has so far found carbon leakage risk to be low in the power sector and aviation sectors. This evaluation found carbon leakage risks to be greatest for commodity producers (meaning energy intensive industries producing globally traded commodities) who had minimal ability to pass on UK ETS costs to their customers, but risks were also found for installation operators in other energy intensive industries.

Some UK ETS participants and traders made wider comments about the UK ETS. For example, many would like to see closer alignment between the UK ETS and EU ETS, with some stakeholders calling for some form of linkage between the UK ETS and the EU ETS, both to increase the size of the UK ETS market and to formalise future alignment of the two systems.

For further information about the evaluation, please contact Mary Anderson at CAG Consultants (ma@cagconsult.co.uk).